S.C. bill advancing to make period products tax-exempt

COLUMBIA, S.C. (WRDW/WAGT) - If you buy gift-wrapping paper, livestock, or even a rollercoaster in South Carolina, you won’t pay any sales tax.

But you will on a box of tampons.

Despite being a monthly essential for many South Carolinians, period products, like tampons, pads, and menstrual cups, are not tax exempt as other medical use products are.

“Period products are medical necessities. The FDA actually classifies them as Class II medical devices for tampons, and pads as Class I medical devices,” Ashley Lidow of the Women’s Rights and Empowerment Network said.

MORE FROM THE S.C. STATE HOUSE:

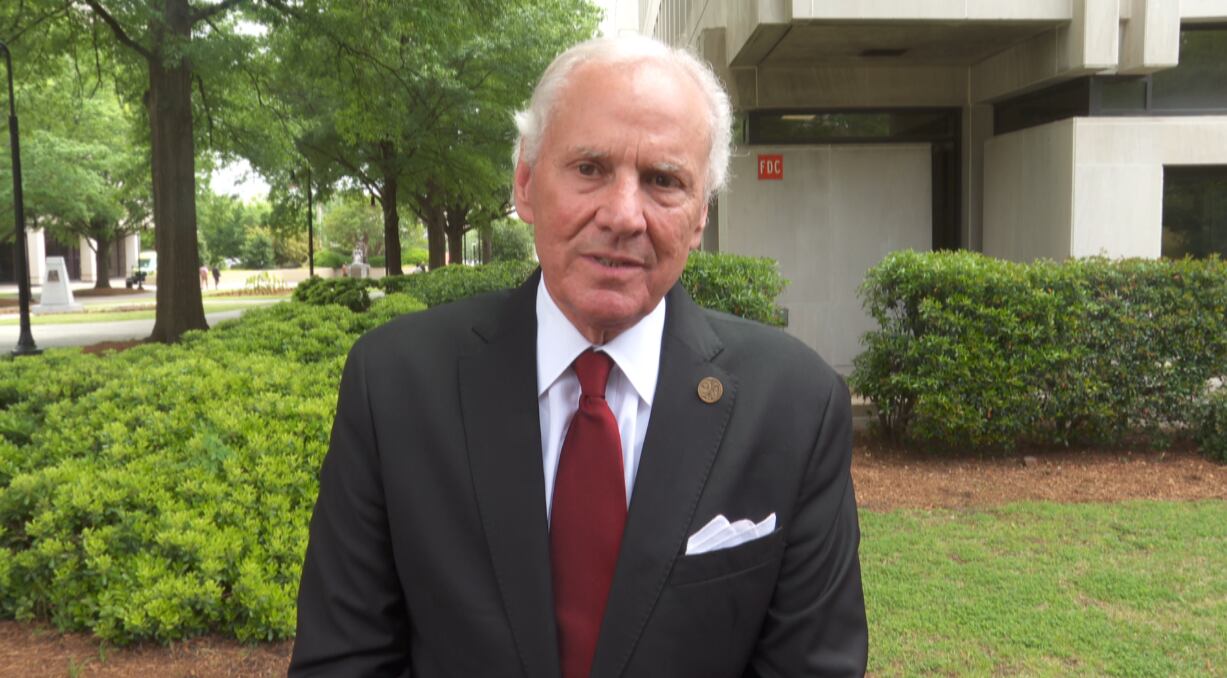

McMasters weighs in on report about $1.8B mystery

Gov. Henry McMaster is weighing in on a scathing report from lawmakers that claims South Carolina’s elected treasurer is at fault for a nearly $2 billion debacle.

South Carolina getting more women in state leadership roles

The election of a sixth woman to the Senate pulled S.C. from last place in women in its upper chamber. South Carolina women have also started organizing in groups.

Senate opposition leaves S.C. energy bill with listless future

Before a bill that ers said will help South Carolina keep the lights on as the state rapidly grows could get debated on the Senate floor, several senators spoke out against the proposal.

What should S.C. lawmakers do with $600 million surplus?

Lawmakers have some ideas on where to allocate surplus funds that will benefit the state’s taxpayers, but differing views could lead to a big fight soon.

A bipartisan bill advancing at the State House, H.3563, would exempt period products from state and local sales taxes — a cost that ers argue is only imposed on a specific group of South Carolinians and disproportionately affects many of them.

“Two in five menstruaters in South Carolina report struggling to purchase pads, tampons, and liners,” Karen Dudley-Culbreath, executive director of the Greenville-based nonprofit The Period Project, testified to an all-male Senate Finance subcommittee Wednesday.

Dudley-Culbreath sees it firsthand.

Her organization has distributed more than 130,000 period packs around the state, focusing on South Carolina schools especially.

“Not having access diminishes one’s dignity, contributes to mental and physical health issues, and impacts the viability of our state,” she said.

The bill senators advanced Wednesday to the full Finance Committee has already ed the House of Representatives unanimously. It needs to get through the Senate in the next few weeks, before the legislative session ends in mid-May, to reach the governor’s desk.

Sen. Katrina Shealy, R – Lexington and the lead sponsor of the Senate version of the legislation, expects it will soon be on the floor of the upper chamber, where she anticipates it will also .

Shealy said this tax should have been removed long ago.

“This is something that is so needed in South Carolina because there are so many women, as you heard them say, that’ll miss school, young girls that’ll miss school, people that’ll miss their job because they don’t have the products, they’re insecure,” she said.

ers said enacting this would be a huge help for the South Carolinians dealing with period poverty, so they don’t have to make the decision of whether to buy these products instead of groceries or gas.

“It’s time to acknowledge that menstrual hygiene products are not luxury items but essential items for the health and dignity of individuals,” said Thrisha Mote, a junior at the University of South Carolina and co-founder of the advocacy group No Periods Left Behind, which raises awareness about period poverty on campus.

A fiscal impact report found local governments combined would lose about $1.4 million annually by exempting these products from sales taxes, while the state would be out about $6 million each year.

Advocates argue in light of the $13 billion proposed state budget, that’s not a huge hit for state coffers.

Copyright 2024 WRDW/WAGT. All rights reserved.