I-TEAM | ‘Very frustrated’: Homeowners feel ignored by insurance companies

AUGUSTA, Ga. (WRDW/WAGT) - The Tax Assessor’s Office is continuing to assess property damage throughout Richmond County after Hurricane Helene.

They have inspected nearly 14,000 properties so far — 40% of which are damaged by Helene.

Insurance companies must settle claims within 40 days of the date the claim was filed. But two months after the hurricane, low-ball offers are delaying payments and putting rebuilding on pause.

The longer homeowners wait for settlements, the longer their homes are exposed to elements, which create other problems like mold that are typically not covered under homeowner’s insurance.

“We had a total of 1,2, and there are two more trees back there,” said Jenna Scott, a homeowner in Richmond County.

There were a total of 10 trees falling, crushing the fence, ripping off gutters, smashing through the roof and cracking the walls of Scott’s home.

MORE I-TEAM COVERAGE ON HELENE:

- Hurricane Helene damages historic cemeteries in Augusta

- Helene has displaced students at nearly every Richmond County school

- A look at Helene’s impact on mail-in voting

- A look at how officials assess Hurricane Helene damage

- Some say FEMA aid isn’t coming fast enough

- What to look out for when choosing a roofing company

- How to protect your home, wallet from tree damage

“I feel like every time a tree fell, it hit something,” she said.

The hardest hit came after Helene.

Liz: “You look like you’re about to cry.”

Scott: “I am. It’s very frustrating.”

The estimate from the insurance adjuster will only cover a fraction of the cost to make her house whole again.

“So, I am sitting with a $19,000 bill. The adjuster came out because we removed all of the trees. I get the estimate and they’re only going to cover $3,300,” said Scott.

The same insurance company that paid her $1,600 for the removal of one tree last year paid her $3,300 for the removal of seven trees this year.

Liz: “How is that possible?”

Scott: “I have no idea. I have no idea.”

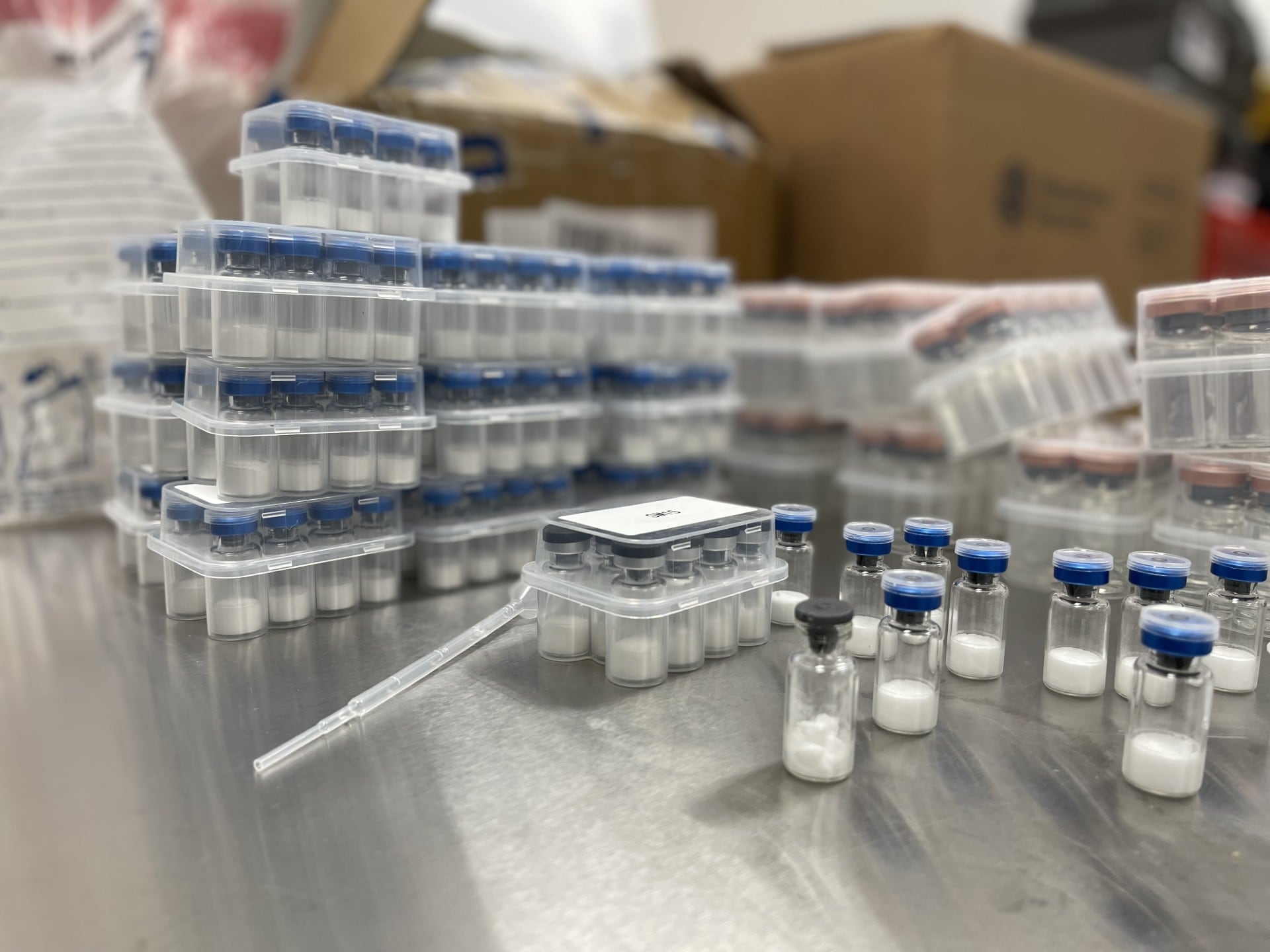

More and more fake weight loss pills flooding into Georgia

As common weight loss drugs become more popular, so are attempts to counterfeit them, often with dangerous outcomes.

“It’s a law of averages. If you have 100,000 claims in Augusta, I feel like the insurance carriers gamble and bet on okay, 50% of these people are going to take the initial offer and walk away,” said Matt Fainter.

Fainter is a licensed public adjuster with Georgia Public Adjusting, Inc.

Insurance adjusters represent the interests of the insurance companies. Public adjusters represent the interest of the policyholders.

It’s in Fainter’s interest to negotiate a high settlement because public adjusters are commissioned from it.

Liz: “So, you say your industry is fairly new, correct. Why was it created?”

Fainter: “Well, I believe that some of the carriers, were probably not being as fair and equitable with the settlements.”

Fainter: “So, you know, right off the bat, when I started looking into his estimate, I just noticed glaring things right off the bat.”

Glaring as the broken beam in John Ball’s attic.

MORE FROM THE I-TEAM:

- Group involved in Burke County eavesdropping dispute speaks out

- 911 calls give new details around the arrest of Burke County man

- Unrest between Burke County property owners has gone on for years

- Facebook video lands Burke County man in jail for ‘eavesdropping’

“This whole beam all the way across has to be replaced. Every single rafter has to be replaced. And then you also have electrical,” said Fainter.

Ball’s policy includes ordinance coverage, meaning his insurance company covers a percentage of the cost to bring an older home up to code during construction.

“Once this is all opened up, all this decking has to be brought up to code. And so this is what’s not correct,” said Fainter.

Also left blank was work for Ball’s driveway.

“The driveway that was destroyed through the process of all the machinery that came on and grinded down the stump of the tree and cutting up the remains,” said Fainter.

Also missing from the estimate, “So many different trades involved, the coordination, the complexity of all those trades, you know, maneuvering around this property. There’s a thing on here called overhead and profit. And it was left off,” said Fainter.

Fainter uses the same software as the insurance companies. He enters his client’s insurance policy along with data and photos of damage.

Meanwhile, the software uses real-time to track the local cost of labor and materials to make the repairs.

The software runs all of the information goes through an algorithm to calculate the estimate.

“Huge. $30,000 to $101,000 is a lot of room to play with,” he said.

FEMA funds are dwindling, director warns senators

The money available to help communities like Augusta has shrunk after back-to-back hurricanes Helene and Milton, the Federal Emergency Management Agency chief said Wednesday.

His estimate is more than $70,000 higher than the estimate provided by Ball’s insurance company.

Scott said: “All I am trying to do right now is trying to figure out how we are going to fix our house, how to pay the tree people because they are calling me daily.”

Scott texted the I-TEAM the following day after her interview.

“I got a call from my adjuster. They revised my claim and ended up giving me more money,” she said.

The additional $8,000 is still not enough to pay the tree removal bill.

Liz: “Why do you have to fight it?”

Fainter: “Well, I think with the big corporations, I mean, I really feel like they’re protecting the shareholders ultimately.”

Scott: “Insurance is supposed to be there to protect your house and make your house whole again.”

But who is protecting the insured who feel ignored?

The state insurance commissioner oversees insurance companies and has the authority to hold them able for not honoring policies.

The insurance commissioner in Florida did just that this past spring, imposing a million-dollar fine on an insurance company for altering claims after Hurricane Ian.

Copyright 2024 WRDW/WAGT. All rights reserved.