SCDOT eyes law change that would impact how much EV drivers owe state

COLUMBIA, S.C. (WIS) - South Carolina’s gas tax is at its peak, and a substantial amount of money in recent state budgets has gone toward road work.

But South Carolina’s secretary of transportation says the Department of Transportation’s dollars don’t go as far as they used to, which could be an obstacle to keep up with population growth.

“We don’t expect that growth to slow down. We must rethink how we approach business so we do not become a victim of our own success,” Secretary of Transportation Justin Powell told the Senate Transportation Committee last week during his 2025 “State of SCDOT” report.

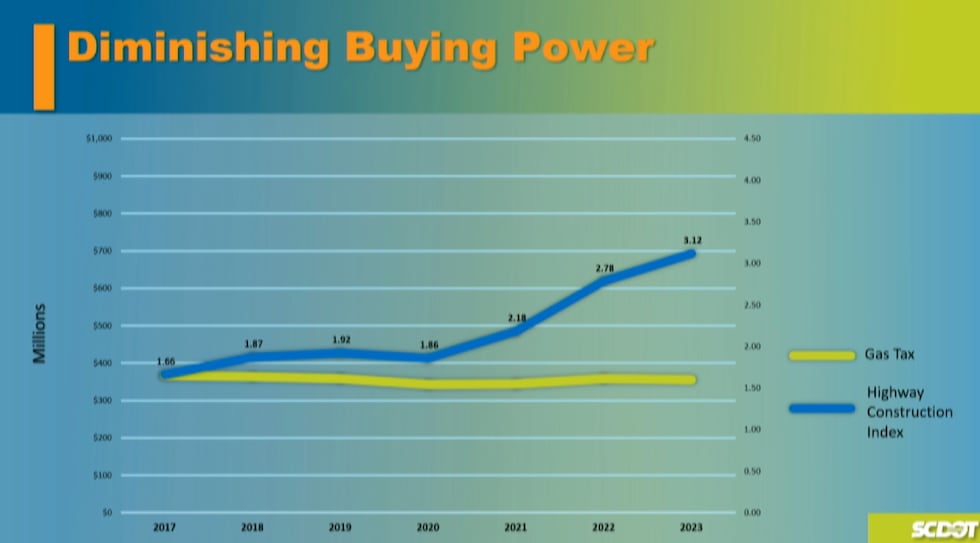

Powell said SCDOT’s buying power has significantly eroded over the last three years, reducing how many projects it can complete each year under its current budget.

“Part of that is the inflation that we’ve seen in our household budgets and our business budgets,” he said. “But a big part of it is that the gas tax simply doesn’t buy as much as it used to.”

Powell thinks a potential solution could come at the State House, in revisiting the 2017 law that implemented an increase to South Carolina’s gas tax.

Under it, drivers now pay an extra 28 cents on every gallon of gas they buy, which helps fund road work — about $1 billion annually, according to Powell.

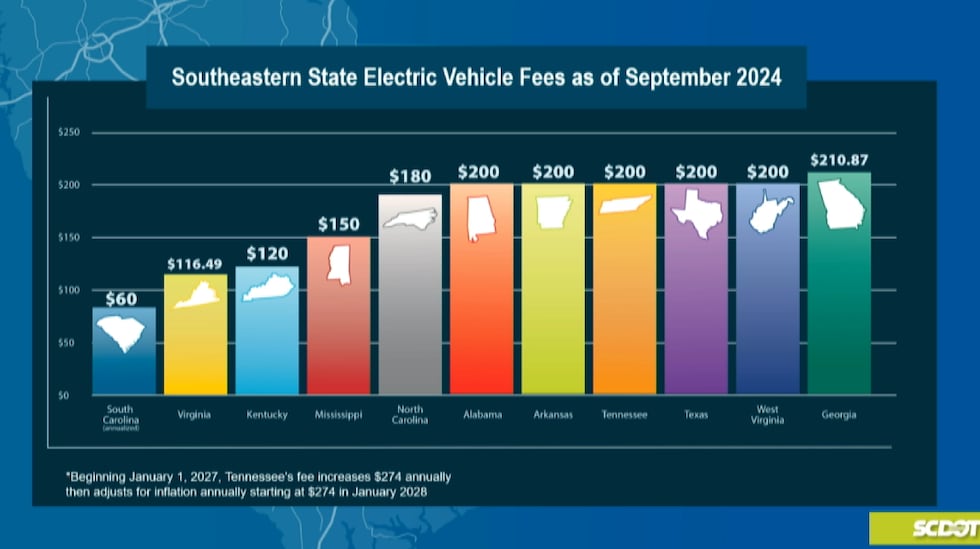

But electric vehicle drivers pay a flat $120 every other year, just a fraction of the $200-plus the average internal combustion engine driver pays annually in gas taxes.

“It’s about making sure that everybody is paying their fair share into the system and that we don’t lose the momentum of what we’ve accomplished over the last seven-and-a-half years,” Powell said.

A growing number of states are imposing a tax on the electricity EVs pull from charging stations, and many charge an annual or biennial flat-rate fee, as South Carolina does.

But South Carolina’s fee trails behind its regional neighbors, with most southeastern states already setting their EV rates closer to their gas tax rates and drawing in that additional money — something South Carolina cannot do unless the law changes.

Among its closest neighbors, Georgia’s annual $210 fee tops the region, while North Carolina charges $180 yearly.

“I think this is something the General Assembly will need to consider in the coming years to make sure that we don’t lose the momentum we’ve seen in investing in our network,” Powell told senators.

It comes as the department is finalizing its next long-term plan, called “Momentum 2050.”

Powell said SCDOT cannot implement this roap without larger discussions about how they plan and pay for the future.

“Our state highway system is something that touches every resident. From the moment they drive out of their driveway, you’re on the state’s system. It’s important not only that we maintain that but that we expand it,” Sen. Larry Grooms, R- Berkeley and chair of the Senate Transportation Committee, told Powell.

SCDOT surveyed South Carolina residents to formulate the Momentum 2050 plan, asking about the top road concerns that impact their daily travel.

Their top response, by far, was congestion and bottlenecks, which drew nearly two-thirds of responses, while road conditions came in second with about a quarter of answers.

Feel more informed, prepared, and connected with WIS. For more free content like this, subscribe to our email newsletter, and our apps. Have that can help us improve? Click here.

Copyright 2025 WIS. All rights reserved.